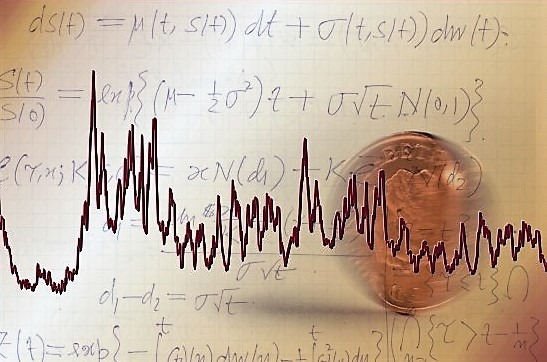

Data driven financial research

We look at many of the important challenges in financial mathematics through the lens of latest developments in machine learning. Some of the problems of interest include data driven portfolio risk measurement including market, credit and operational risk for large banks. Portfolio optimization while managing the return-risk trade off. Pricing and hedging high dimensional options. Measuring systemic risk in the banking system, and so on.

Weather and climate modelling

We are developing machine learning based models that combine historical data with output from physics based numerical weather prediction models to improve monsoon weather prediction in India. We are also using ideas from extreme value theory to develop algorithmic methodologies to predict weather related extreme events including high precipitation, heat waves, cyclones, flooding, etc.

Reinforcement learning

Reinforcement learning finds wide applications in diverse areas including healthcare, autonomous vehicles, robotics, financial trading and portfolio risk measurement, traffic modelling. In the center we focus on methodological issues associated with the underlying reinforcement learning models to arrive at accurate and computationally efficient algorithms for massive RL models, exploiting latest developments in machine learning.

Epidemiological modelling

Infectious diseases such as Covid have been a subject of great deal of analysis through mathematical modelling, simulation and machine learning models. In the centre we will collect relevant data and develop cutting edge agent based simulation models models to help study disease spread and predict its evolution trajectory.